The following is a cross-post from Tradeology, the official blog of the International Trade Administration

By Natalie Soroka, Economist, International Trade Administration, Office of Trade and Economic Analysis

As we kick off Small Business Week, the Census Bureau released its “Profile of U.S. Importing and Exporting Companies, 2014-2015.” A joint project of the Census Bureau and International Trade Administration, this series details the characteristics of U.S. companies that imported or exported goods in 2014 and 2015, including information on company size, industry, geographic composition, and trading partners. When we look at the trade data, small and medium sized enterprises play a huge role in economic growth and job creation.

In 2015, nearly 408,000 companies in the United States traded goods internationally, with nearly 295,000 companies exporting goods and almost 197,000 companies importing goods from abroad. The majority of these companies were “small and medium-sized enterprises,” or SMEs, with fewer than 500 employees. In 2015, SMEs accounted for 98 percent of goods exporters and 97 percent of goods importers. However, in terms of known dollar value, large companies account for a larger share of trade, with SMEs only accounting for about a third of U.S. goods trade.

In 2015, the value of “known” U.S. goods exports (export transactions that can be linked to a specific exporter) fell by 7.7 percent from the prior year, so it doesn’t come as a surprise that the number of goods exporters in 2015 was also lower than 2014, falling by 3.4 percent. This drop is attributed to fewer small company exporters with fewer than 100 employees, as the number of medium-sized (250-499 employees) and large exporters increased slightly.

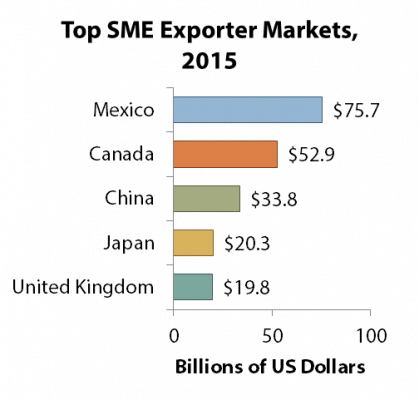

With regard to markets, the number of exporters selling goods to Canada decreased the most, with most of those losses being very small companies with fewer than 20 employees. However, large firms accounted for most of the decrease in known export value to Canada. SME exports increased to several of the top 25 U.S. markets: Belgium, Switzerland, India, and Chile. While overall exports to most of these partners fell, higher exports from SMEs to India offset lower exports from large companies to result in an overall increase in U.S. known goods exports to India in 2015. The value of exports from large companies rose to the United Kingdom, Saudi Arabia, United Arab Emirates, and Germany.

While many companies solely export or solely import, about a fifth of these companies engage in both directions of trade, exporting and importing merchandise. These companies are also responsible for the majority of the known trade value, accounting for 85 percent of known goods exports and 93 percent of known goods imports in 2015.

Similarly, while most companies only engage with one trading partner, those companies selling to partners in multiple countries account for most of exports, by value. For example, the 7 percent of SMEs who exported to 10 or more countries in 2015, accounted for more than half of total SME export value. This is even truer for large companies, where the 44 percent of large companies that exported to 10 or more countries accounted for 96 percent of the overall value of exports from large firms.

The data in this report show that many small and medium-sized companies could expand their export sales to additional markets. The International Trade Administration offers many services to help U.S. companies begin exporting or increase their sales. Businesses of any size can contact their nearest Export Assistance Center to find out more about our programs and resources.

For more information regarding U.S. importers and exporters in 2015, see ITA’s fact sheet or read the full Profile.

Join us in the conversation on social media using #SmallBusinessWeek. Tag us on Twitter using @TradeGov and share the success of your small business.