The following is a cross-post from Tradeology, the official blog of the International Trade Administration

By Elizabeth Schaefer, Director of Investment Research, SelectUSA

Following the flurry of activity from the SelectUSA Investment Summit, it is always a welcome change of pace to take some time in the heat of Summer to reflect on the state of foreign direct investment (FDI) in the United States. As SelectUSA’s resident economist, taking stock of how things have changed isn’t just figurative; it is quite literal.

So, I was excited to see that the United States had reached a record total of $4 trillion in FDI stock, according to 2017 FDI Inward Stock data released by the Bureau of Economic Analysis (BEA).

Foreign direct investment, as defined by BEA, generally captures a long-term relationship with the management of a foreign enterprise which is usually linked with the real output of the country in which it operates.

This updated data, measured by ultimate beneficial owner (meaning that there is a majority foreign-owned entity atop its U.S. affiliate’s ownership chain), provides a picture of which economies are the largest and fastest growing investors in the United States. The $4 trillion mark is an exciting and new record. But in 2017 alone, the flow of FDI into the United States was $277.3 billion.

It is important to note that these annual flows can be volatile, rising one year and falling the next depending on a wide array of global factors. Indeed, in 2017, the annual FDI flow dropped 41 percent from 2016. According to the United Nations Conference on Trade and Development, 2017 was a year of decreased FDI flows around the world, so a decrease in the United States fits the global business pattern. Despite the decrease, the United States still maintains the title of the world’s top FDI destination.

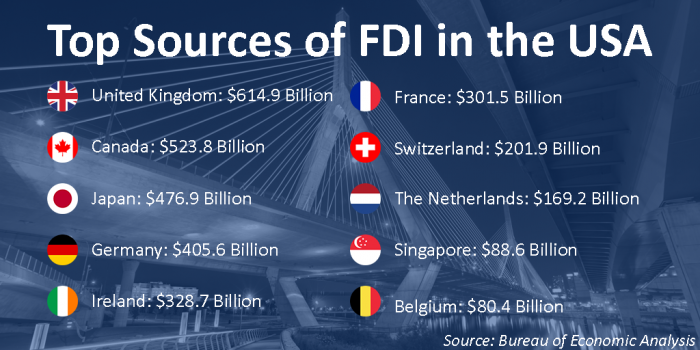

The latest available data also shows continued, strong investment relationships with markets like the United Kingdom ($614.9 billion total stock), Canada ($523.8 billion), Japan ($476.9 billion) and Germany ($405.6 billion). In fact, these top four sources combined account for more than half of all FDI in the United States. However, the top four fastest-growing sources—collectively accounting for less than three percent of the total stock—are Greece ($1 billion), Argentina ($4.6 billion), Thailand ($2.2 billion) and Singapore ($88.6 billion).

What’s Next?

BEA will release more FDI data November 8, including the number of jobs directly supported, state and industry specifics, research and development spending, and more. Stay tuned for details on a SelectUSA webinar on the data later this year! Sign up for email updates and visit SelectUSA.gov for FDI fact sheets, interactive data tools, and more.

You can also follow our #FDIintheUSA campaign on Twitter!